Starting a business is exciting, but one of the most important early decisions you’ll make is choosing the right legal structure for your company. Your choice affects taxes, liability, ownership, fundraising, and even how you run day-to-day operations.

This guide explains the most common business entity types – C Corporations, S Corporations, LLCs, partnerships, and sole proprietorships – to help you understand the differences and make a more informed decision.

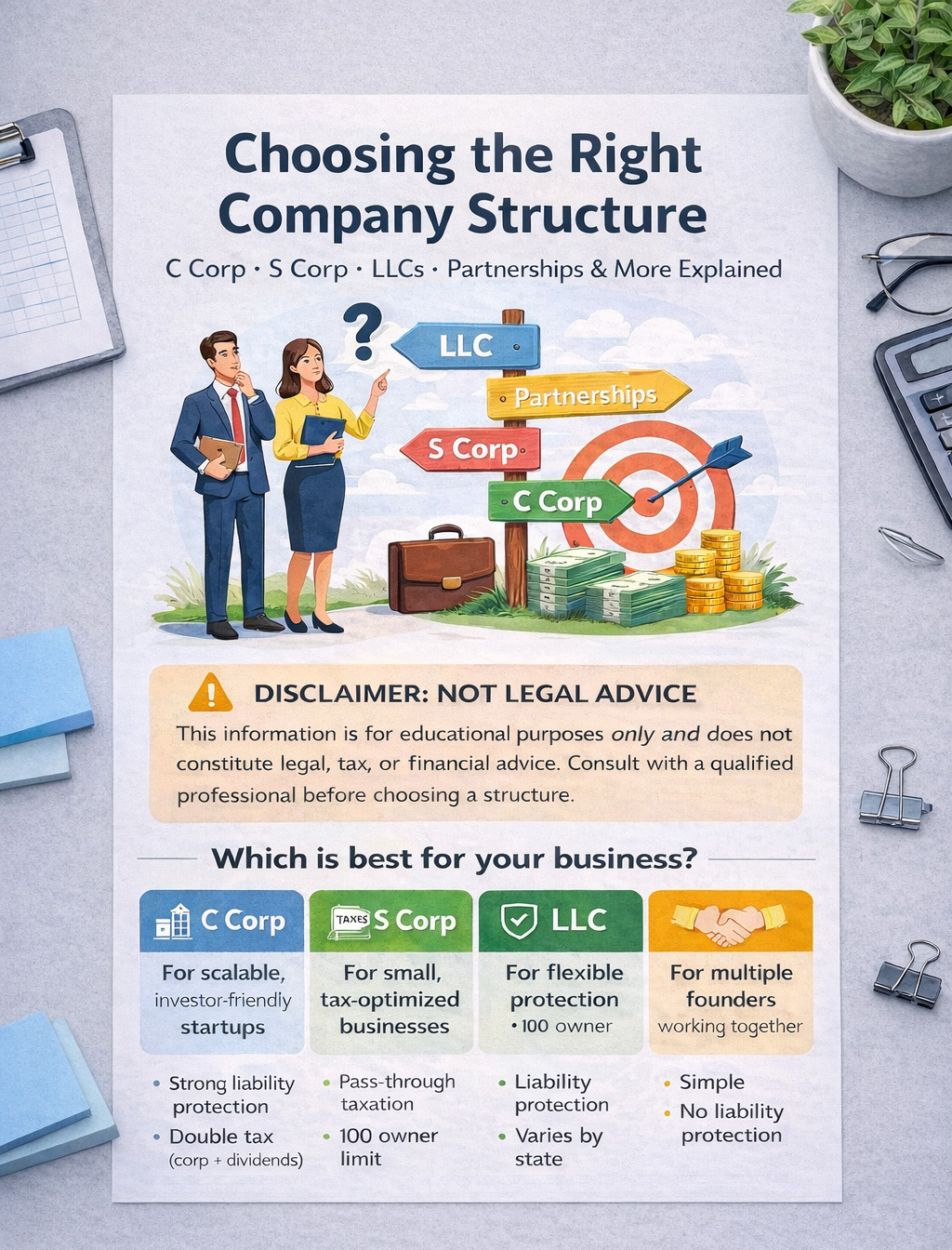

⚠️ Disclaimer: Not Legal or Tax Advice

This article is for general informational purposes only and does not constitute legal, tax, or financial advice. Laws and regulations vary by jurisdiction and change over time. Always consult a qualified attorney, accountant, or tax professional before choosing or changing your business structure.

Why Business Structure Matters

Your company’s legal format determines:

- How much personal liability protection you have

- How and when you pay taxes

- Who can own shares or interests

- How easy it is to raise capital

- Ongoing compliance and reporting requirements

There is no one-size-fits-all solution. The best structure depends on your goals, location, and growth plans.

Sole Proprietorship

Best for: Solo founders just getting started

A sole proprietorship is the simplest form of business. There is no legal separation between the owner and the business.

Pros

- Easy and inexpensive to set up

- Minimal paperwork

- Full control by the owner

Cons

- No personal liability protection

- Personal assets are at risk

- Harder to raise capital

Partnership (General & Limited)

Best for: Two or more founders working together

A partnership involves two or more people sharing ownership.

General Partnership

- All partners manage the business

- All partners share liability

Limited Partnership (LP)

- General partners manage the business

- Limited partners have reduced liability and involvement

Pros

- Simple structure

- Shared responsibility

- Pass-through taxation

Cons

- Personal liability (especially in general partnerships)

- Disputes can arise without strong agreements

Limited Liability Company (LLC)

Best for: Small to medium businesses seeking flexibility

An LLC combines the liability protection of a corporation with the tax simplicity of a partnership.

Pros

- Personal liability protection

- Flexible management structure

- Pass-through taxation by default

- Fewer formalities than corporations

Cons

- Varies by state

- Some investors prefer corporations

- Self-employment taxes may apply

LLCs are popular because they are simple, flexible, and protective, especially for service-based businesses.

C Corporation (C Corp)

Best for: High-growth startups and companies seeking investors

A C Corporation is a separate legal entity owned by shareholders.

Pros

- Strong liability protection

- Unlimited shareholders

- Preferred by venture capital and institutional investors

- Easy to issue stock

Cons

- Double taxation (corporate income + shareholder dividends)

- More compliance and reporting

- Higher setup and maintenance costs

C Corps are often the standard choice for tech startups and scalable businesses.

S Corporation (S Corp)

Best for: Small businesses wanting tax advantages

An S Corporation is not a separate entity type, but a tax election made with the IRS.

Key features

- Pass-through taxation (no corporate income tax)

- Owners can receive salary + distributions

Limitations

- Maximum of 100 shareholders

- Shareholders must be U.S. citizens or residents

- Only one class of stock allowed

- Not all states recognize S Corp status in the same way

Because of these restrictions, S Corps are best for closely held U.S.-based businesses.

Quick Comparison Table

| Structure | Liability Protection | Taxation | Best For |

|---|---|---|---|

| Sole Proprietorship | No | Personal | Individuals starting out |

| Partnership | Partial | Pass-through | Multiple founders |

| LLC | Yes | Pass-through (default) | Small & medium businesses |

| S Corp | Yes | Pass-through | Tax-optimized small businesses |

| C Corp | Yes | Double taxation | Startups & investors |

How to Choose the Right Structure

Ask yourself:

- Do I need investors?

- How important is tax flexibility?

- Do I want strong liability protection?

- Where is my business legally registered?

- How complex can I manage compliance?

Your answers will help narrow down the best option.

Final Thoughts

Choosing the right company format is a foundational decision that can shape your business’s future. While structures like LLCs and corporations offer valuable protections and benefits, the “best” choice depends on your specific situation.

Before finalizing your decision, speak with a qualified legal or tax professional who understands your goals and local regulations.

Once you have decided which company structure suits your needs best, we can help print your custom minute book to hold all your company documents in place. These books include a company seal for all your official documents.